Business Intelligence Vs Analytics Definition

If someone puts you on the spot, could you tell him/her what the difference between business intelligence and analytics is? If you feel a bit uncertain about the specifics here, you're not alone, experts aren't in agreement either! There is not a clear line between business intelligence and analytics, but they are extremely connected and interlaced in their approach towards resolving business issues and providing insights on past and present data, and defining future decisions. While some experts try to underline that business analytics focuses, also, on predictive modeling and advanced statistics to evaluate what will happen in the future, BI is more focused on the present moment of data, making the decision (and future of a company) based on current insights. But let's see in more detail what experts say and how can we connect and differentiate the both.

We already saw earlier this year thebenefits of Business Intelligence and Business Analytics. Let's dig deeper now and figure out what this is all about, what makes them different, and how they are complementary to each other.

What Do The Experts Say?

In an article tackling BI and Business Analytics, Better Buys asked seven different BI pros what their thoughts were on the difference between business intelligence and analytics. Each and every professional had a different take. Here are a few snippets of their opinions:

"BI is needed to run the business while Business Analytics are needed to change the business." – Pat Roche, Vice President of Engineering at Magnitude Software

"BI is looking in the rearview mirror and using historical data. Business Analytics is looking in front of you to see what is going to happen."– Mark van Rijmenam, CEO / Founder at BigData-Startups

"What's the difference between Business Analytics and Business Intelligence? The correct answer is: everybody has an opinion, but nobody knows, and you shouldn't care."– Timo Elliot, Innovation Evangelist at SAP

Well, what if you do care about the difference between business intelligence and data analytics? It doesn't matter if you run a small business operation or enterprise, if you have to make decisions that will affect you in the short or long run, it is wise to use both. Business intelligence and analytics will provide a company with a holistic view of the raw data and make decisions more successful and cost-efficient.

What Is Business Intelligence And Analytics?

Business intelligence and analytics are data management solutions implemented in companies and enterprises to collect historical and present data, while using statistics and software to analyze raw information, and deliver insights for making better future decisions.

Let's face it: both terms provide insights into the business operation and future decisions, but it comes down to the differences into how they do it and what information exactly do they provide.

It seems clear that there isn't one standard "correct" definition of the differences between the two terms. The varying opinions given by the experts is evidence of that. So, instead of trying to find the "right" answer, let's find a useful distinction between the two that can be used simply and clearly to help you in your work. The most straightforward and useful difference between business intelligence and data analytics boils down to two factors:

- What direction in time are we facing; the past or the future?

- Are we concerned with what happened, how it happened, or why it happened?

Keeping in mind that this is all a matter of opinion, here are our simplified definitions of business intelligence vs business analytics.

Business intelligence –Deals withwhathappened in the past andhow it happened leading up to the present moment. It identifies big trends and patterns without digging too much into thewhy'sor predicting the future.

Business analytics –Deals with thewhy'sof what happened in the past. It breaks down contributing factors and causality. It also uses thesewhy's to make predictions of what will happen in the future.

Confused yet? Let's use an example from football as a metaphor to help clarify things.

Business Intelligence vs Business Analytics As Seen Through Football

Let's say you're on the coaching staff of a football team and you want to review the most recent game. You do this to see how you can fix your errors and replicate your successes.

Using our previous definitions,BI would be the process of identifying all the statistics and plays that led to your team winning. It would identify that you kept possession of the ball for much longer than your opponents. It would also identify the trend that your right side of the field was instrumental in retaining possession through excellent passing.

Business analytics would be more concerned withwhyyou had possession of the ball for longer than your opponent and why your right side of the field did so well at passing.

Was it because:

- Your opponent's defenders on that side were weaker players than their defenders on the other?

- Your right-side players had been putting in more time on the field together then your left side?

- One of your players on the right was simply having a phenomenal performance which carried over to the rest of that side?

These questions are important. They allow you to figure out how you can replicate your success, or prevent your failure in the future. Asking theright business intelligence questions will lead you to better analytics. While using a business dashboard, all the insights can be simplified into a single place, making the time for meaningful decisions much faster. But first, we need to analyze the difference more, as that will help us to understand what to do in a company's operation process, and how to chose the best tool to manage your insights.

Without further ado, let's dive deeper into the difference between business intelligence and data analytics. In order to do so, we need to examine the distinction between correlation and causation.

Correlation Is Not Causation

When two things are correlated, it means that when one happens, the other tends to happen at the same time. When two things have a causal relationship, it means that one thing leads directly or indirectly to the other happening.

A famous example of the difference between these two is the fact thatice cream consumption and city homicide rates are highly correlated. Now, of course, ice cream does not cause people to murder each other. So clearly there is not a causal relationship.

The two are correlated due to the fact that homicide rates rise when temperatures rise in the late summer. It is theorized that since warmer weather brings more people outside, this leads to more social interaction, some of which is violent.

You Can't Always Trust What You See

You can find examples of people confusing correlation and causation everywhere you look. For example, that muscular person at the gym who always likes to give you work out advice may or may not actually know what they are talking about. The advice they're giving you, while correlated with being known by a muscular person, may not actually lead to being muscular. Instead, they may simply have good genetics. They may be muscular not because of their knowledge, but actually in spite of it.

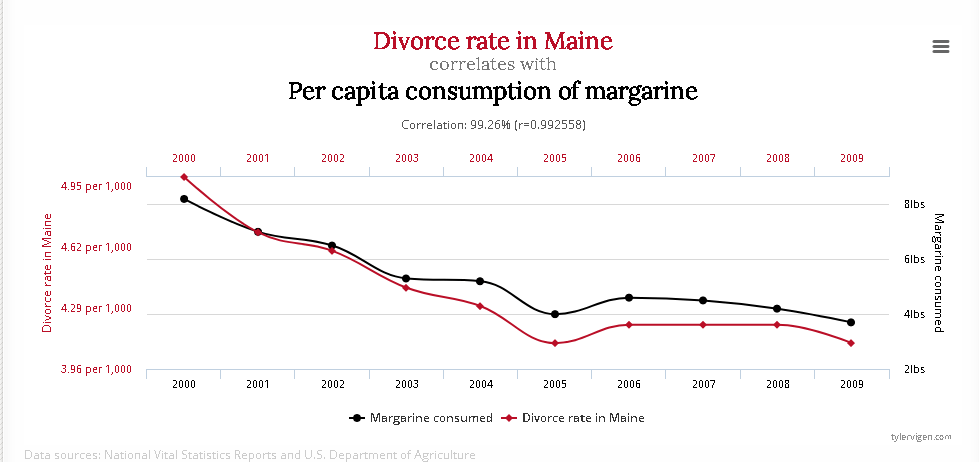

Moving into the lighter side of things, there are some hilarious examples of things being correlated that clearly don't have a causal relationship. Many of them are shown on the website Spurious Correlations. For example, divorce rates in Maine are very closely correlated with per capita consumption of margarine… Maybe married couples should switch to butter instead?

Source: Spurious Correlations ** Click to enlarge **

In all seriousness, it can be extremely difficult, depending on the field, to separate correlation and causation. Very large scale and expensive research trials are often done just to find evidence of causal relationships. Also, a famous example would be the butterfly effect. But we won't go that much into details, and, actually, examine more the business side of things, and, therefore, concentrate on the specifics of business intelligence vs data analytics, and provide insights on correlation and causation in the business realm.

How Does This Apply To Business?

Can you understand the factors that arecausing your business success or failure rather than just the factors that areassociatedwith your business success or failure? If so, it's much more likely that you will be able to predict the future in your marketplace and act accordingly. However, it's important to note that you need to know what's correlated with something before you can know causation.

In other words, you need to knowwhat happened andhow it happened (BI) before you have the ability to saywhy things happened (BA) with any reasonable degree of certainty.

That is the difference between business intelligence and analytics, and that's why both of them are crucial. They fit together like two pieces of a jigsaw puzzle – a puzzle that helps your business to be more profitable. It is of crucial importance to define and use KPI examples that will help to establish a business goal and execute the correlation and causation of business analytics vs business intelligence. While it may sound complicated at the beginning, the more you dig deeper with a data analysis tool, the more sense it will make to establish qualified insights and make better decisions. That is all about: the difference between business intelligence and business analytics is important to understand because it helps to prepare a company for adjusting its operations into a cost-effective and insightful way. Using both into the process of creating a successful business intelligence strategy, will only make a company more competitive on the market.

Use-Case Scenarios

Enough with the descriptions and metaphors. Let's solidify things and wrap up this post with business examples, illustrating the difference between business intelligence and business analytics.

Let's say you work for a marketing firm that uses both business intelligence and analytics to help large e-commerce companies launch new products. In order to understand what new products would be most likely to succeed (analytics), you would need to figure out:

- What products had been most successful in the past (BI)

- The seasonal trends that had influenced success for past launches (BI)

- Why customers bought the past successful products (BA)

For example, let's say that your hypothetical e-commerce store sold boutique women's fashion. You will need to work with yourretail analytics to understand what products will work.

First, you would examine what categories of clothing are driving the most profits. Then, you can examine what times in the year those successful products had been launched. Finally, you could do a series of in-depth customer interviews in order to figure out why customers liked those pieces or categories more than the others.

If you did enoughmarket research, and you had a large enough sample size, you should be able to predict with a great deal of accuracy which new products would be likely to succeed.

This could lead to surprises in the way that you think about your products because your customers often have a very different way of looking at your products than you do.

BI and Analytics Dismantle Assumptions

For example, maybe your assumption was that your customers mainly cared about the price point of your garments.

After your research, however, you found your customers were actually willing to spend more on your products if you emphasized your humane sourcing practices, such as not utilizing sweatshops.

Then, your focus would be on continuing to use that positioning in your marketing messages as opposed to worrying about the price points of your garments so much when doing a product launch.

The above example illustrates one of the fundamental important points of business intelligence and analytics. Your assumptions about your company, your customers, your marketplace, and your products, are often flat out wrong – or at the very least, incomplete. After asking the right questions, analytics are here to help – whichever your industry or sector, be ithealthcare analytics orfinancial business intelligence, you need to use both BI and BA for success.

Business Intelligence And Analytics Industry Examples

It's quite clear that the difference between the both can be examined through real-life examples, so let's analyze few industries that can show the value of both terms.

Human Resources: What are my recruiting options?

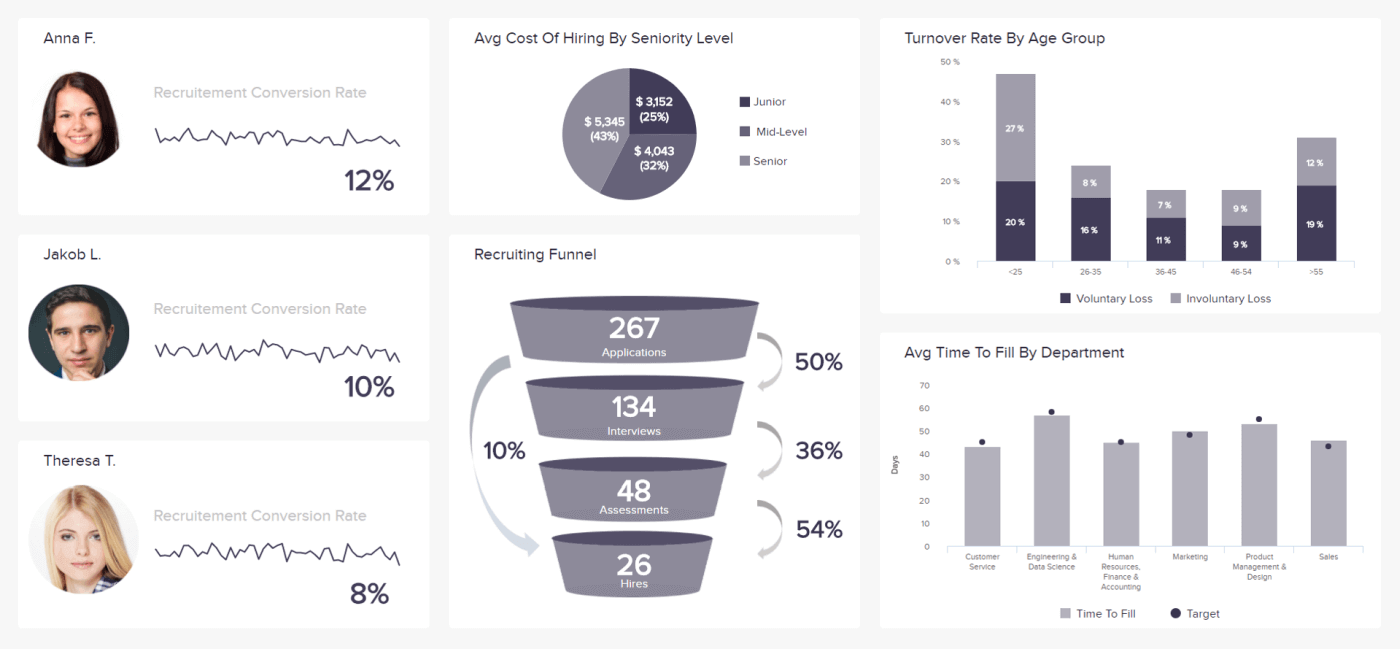

In Human Resources it's all about workforce: engagement of employees, overtime hours, training costs, the overall productivity, cost per hire, recruiting conversion rate, time to fill a position, retention efficiency, part-time employees, etc. When you establish the right HR KPIs for your business, you need to dig deeper into the what happened and how (BI), and then why it happened (BA), to understand how to perform in the future. Let's have a simple look into one full-scale dashboard and see how business analytics vs business intelligence performs.

** Click to enlarge **

This online dashboard above is created for a simple, yet effective overview of the recruiting process in a company. It can be used by a recruiting agency, or in-house – it is meant for HR managers and professionals that need more data and insight into their process, to define future decisions and decrease costs. The goal is to find the right recruitment approach, giving you the best candidates at the lowest cost. To put it in practice, you want to define what kind of process and what happened during the recruiting process, alongside how it happened (BI), and the next question would be why it happened the way you see it on this dashboard (business analytics). Let's say that the average time to fill a position (by a department, in days) didn't go as planned. You can inspect more and see that the conversion rate of the recruiting professionals didn't go as expected, and you have lost precious time and resources to keep up with the market (you have used your historical data and connected it to the present moment – found out that you are losing resources). The average costs of hiring will help you determine the patterns that are occurring as a part of the recruiting cycle. By grasping these data with an online data visualization tool, the amount of time needed to gain those insights will be reduced and could be used in other business processes.

In this example, we can define what happened, how, and then why. Don't be afraid to do your own analysis and create your own HR report that will help you showcase the power of business intelligence vs analytics. This is important since you want to know and define the influences on your operations to consider future undertakings; you want to know what happened, how it happened and why. This is the holistic formula of a successful business.

But let's dig deeper into other industries.

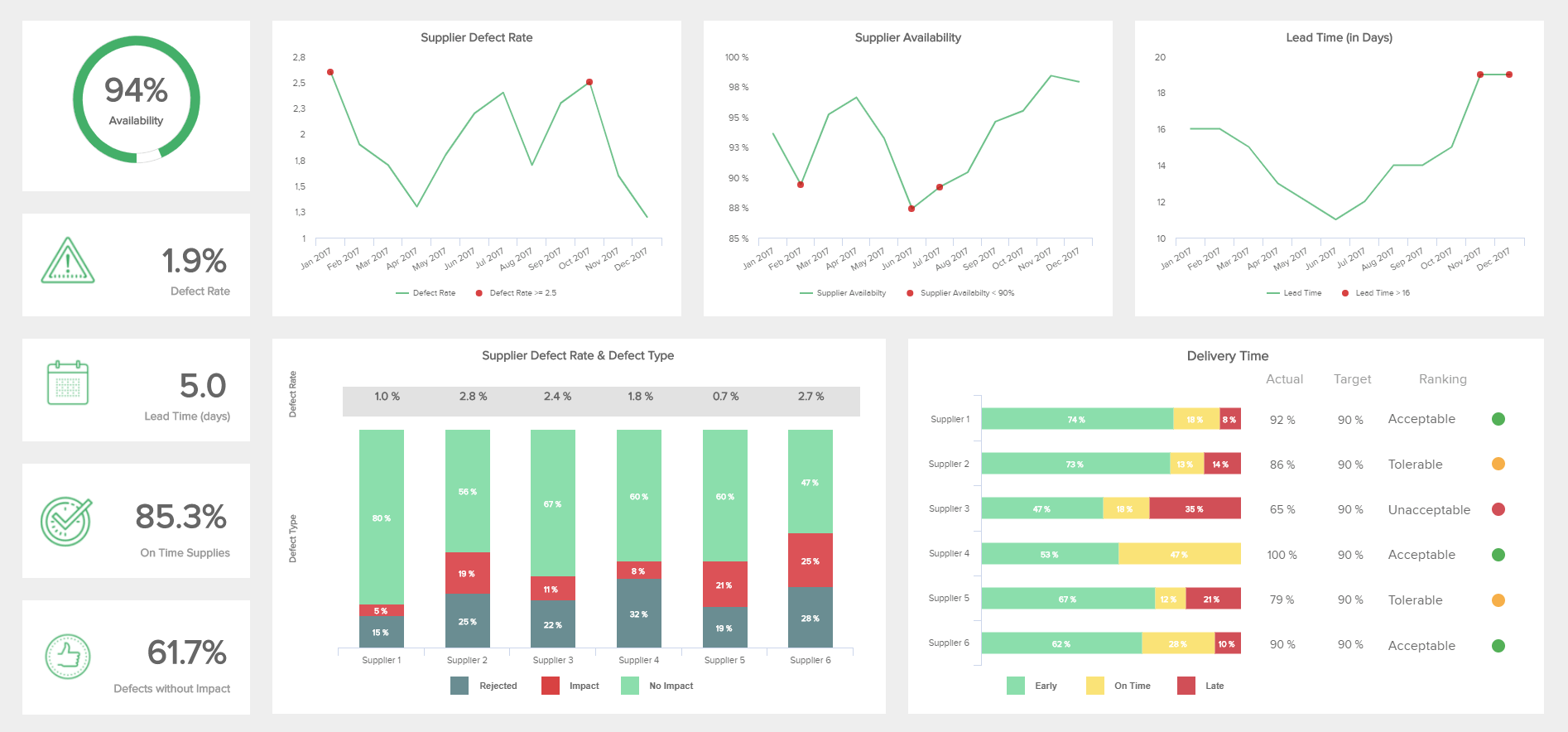

Procurement: Is it possible to outperform my supply delivery process?

** Click to enlarge **

Another example that we can show you to better see what is business intelligence and analytics, and then you can also explore additionally by yourself, is the procurement dashboard, expounding on the supplier delivery performance. As mentioned before, after you establish your indicators, in this case, procurement KPIs, you can dig deeper into the analysis of the business processes to establish a better performance and decide on future company aspects of success. Business intelligence analytics is often used together (even in the wording), which can help you to get a holistic overview, like in the dashboard presented above. It doesn't mean it cannot be used separately, but to make better decisions, you need the best tools you can utilize in this competitive market. That being said, business intelligence vs analytics can show the mentioned correlations and causations that will provide an extensive value to the general business operations and future reasoning of important decisions.

With our last example, we will wrap up what business intelligence analytics can do for a company and how to use it. The advantages are clear, but what about the indispensable features a simple visual overview can provide you with? Using your raw data and assembling a visual representation of all your important performance, historical and present intelligence, you can create a powerful insight tool that will gather and connect the most significant acumen a business needs to manage their small, mid, and big-scale operations, while making balanced decisions and creating a sustainable process. Let's see this through an example.

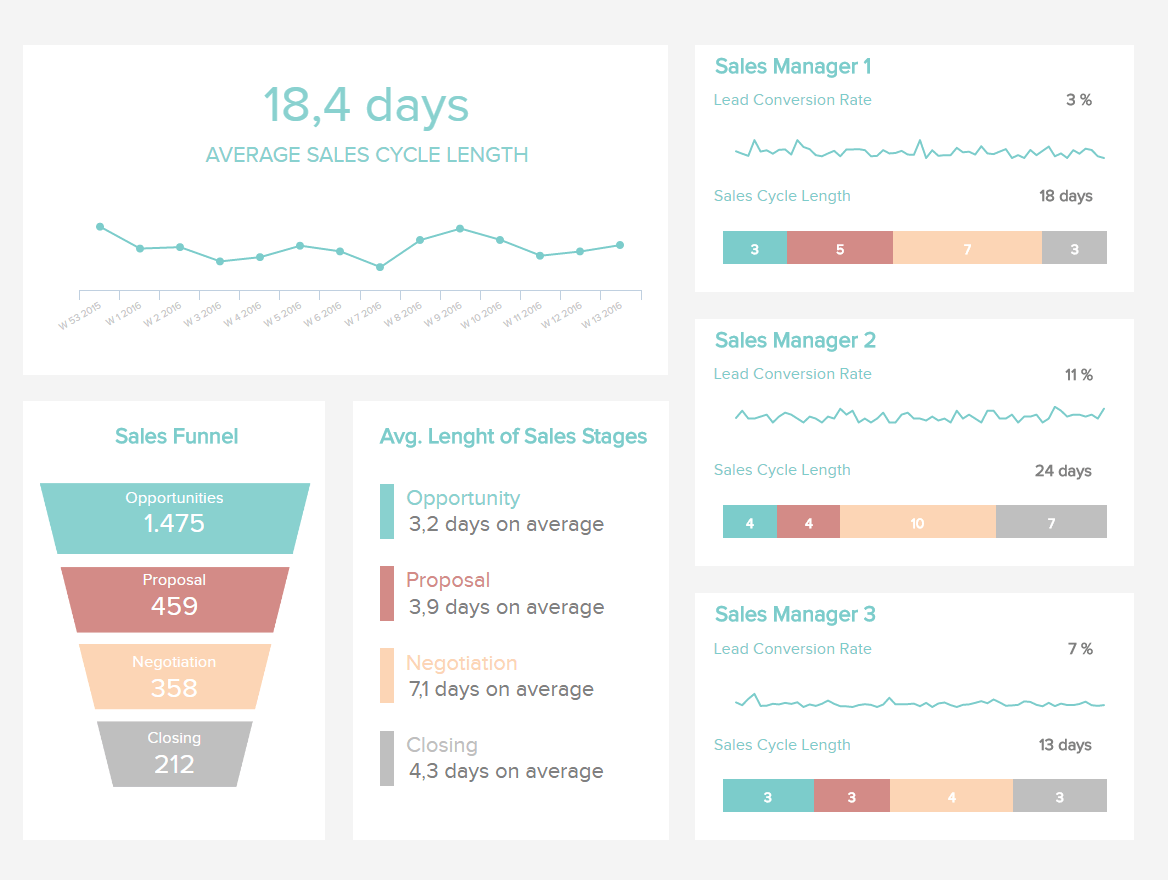

Sales: How to decrease the sales cycle lenght?

** Click to enlarge **

The sales dashboard visualized above reflects on the sales cycle needed to perform the complete process – from potential opportunity to a paid invoice. While compiling the historical data (calculating the average in a define time-preset), with the present insights and trends that are occurring in the sales process, we can dig deeper into the BI of the cycle. We can examine the sales funnel (which can, also, be customized by the particular needs of a business or department), what were the trends and patterns happening during the sales funnel stage, how it affected the complete sales cycle, and who were the top performing representatives from the team. By drilling down the productivity, outperforming processes, the ones that have the less amount of efficiency, a company can easily spot what is working and what is not. If you see the average sales cycle length of 18 days, but your benchmarks are telling you that it should be no more than 15 days, then tackling deeper into the BI angle of conducting research can give you the answer where those 3 days are underperforming. This will give an extra edge for the next sales cycle, as you can easily pinpoint what is the issue, and brainstorm solutions.

By detailing the factors that caused these insights (in plain language, why something happened), adding predictive analytics and examining the, already mentioned, why of these processes, a business can utilize the business analytics point of view – that will help to gather the interconnected data into a comprehensive data-story. If you tackle into the raw sets of data, and leverage the power of statistics to predict the future of your performance, then you have taken the advantage of the entire sequence of the business intelligence vs data analytics sphere.

To conclude the matter that we have examined in this article, with the aim to differentiate both terms, used separately and in correlation with each other, you can now establish which will perform better during your decision-making process and what can you expect from both terms. Nevertheless, we would like to stress the fact that through the complementary uses of business intelligence and business analytics, you can unpack your assumptions and get more accurate and useful data. Put simply, BI and BA give you the tools to see reality as clearly as possible. That being said, the significance of both will affect business operations of a company, be it small or big, and the need to combine both will certainly become an operational must-have for a successful market presence.

This is a competitive advantage that you cannot afford to ignore. Start applying your newly acquired knowledge about "BI vs analytics" with a14-day free trial of datapine'sonline BI tool!

Business Intelligence Vs Analytics Definition

Source: https://www.datapine.com/blog/difference-between-business-intelligence-and-analytics/

0 Response to "Business Intelligence Vs Analytics Definition"

Post a Comment